Uncertainty on the Brno office market

Demand for office space in Brno is changing, companies are more reserved towards commitments due to higher costs. New construction will bring additional metres to the market, which, together with the tenants’ behaviour, will gradually decrease its absorption. Vacant meters will be filled gradually and slowly, which could be fuelled by the arrival of more international companies.

In the first decade of the new millennium, Brno was one of the top markets for R&D and high-tech industries in Central Europe. Thanks to the large number of students and graduates from Brno universities, the local workforce was an attraction for large international companies, which located their shared service centres and production, research and development teams here. Now the situation is changing – the number of students has dropped by about 30 percent, Brno’s promotion abroad and its business approach are insufficient, and new companies prefer to head to Polish regional cities. Existing tenants are consolidating, many of them are reducing the number of meters they lease. The construction trend that started in the boom years will now further extend the office space, but demand for it is limited. It is expected to increase again as the economic situation improves and existing tenants expand.

The majority of office tenants in Brno have long been international shared service centres and technology companies, but over the last decade, the interest of these types of companies to locate their headquarters here has gradually cooled. Decision-making processes have slowed down, attitudes are reserved and willingness to make long-term commitments is low. The uncertainty is due, among other things, to the geopolitical situation, but purely local reasons also play a role: the decline of the formerly large workforce of Brno students, the rising cost of living, or the foreign promotion and business approach of Brno weak than that of comparable (mainly Polish) cities in the CEE region, which is, for example, lacking incentives.

Lukáš Netolický, Head of Regional Cities in the Czech Republic, Cushman & Wakefield: “Another change has been brought about by the spread of hybrid working, whereby companies can reduce the number of permanent workstations thanks to working remotely, while changing the use of office space to better meet the current needs of employees. Ultimately, such change does not always mean a reduction, but often also an increase in the space leased. Of the tenants that are now remodelling their space, about 40 per cent are downsizing, and some companies are consolidating multiple offices into fewer buildings for efficiency. But 30 percent of companies are staying in the same office size even with the layout changes, and another 30 percent are expanding.”

The hybrid model has become a norm that even previously built office buildings will have to adapt to: spaces built in the last decade no longer meet the current needs of employers and employees.

Active development and companies’ consolidation are reducing occupancy, which will continue in the medium term

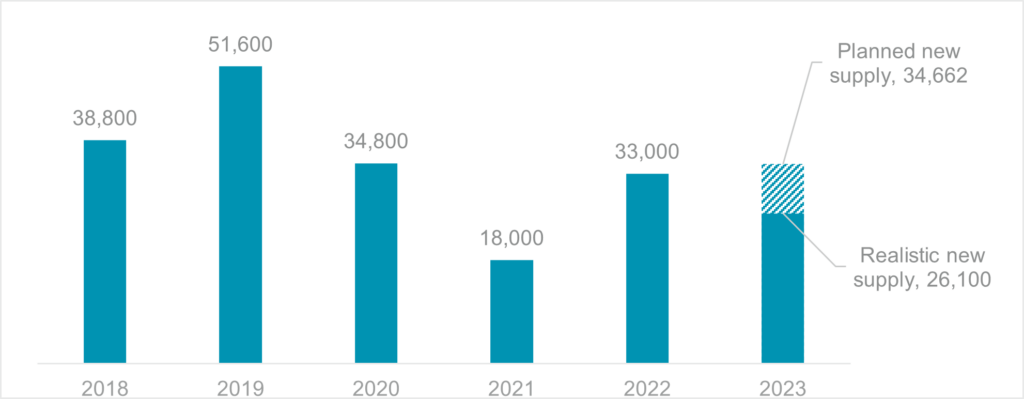

At the same time, new office construction is underway in Brno – 33,000 sq m was completed last year, an increase of 84 per cent on the year before. Another 35,000 sq m is currently under construction, of which 26,100 sq m should be completed this year (if all the developers’ plans are implemented, it will be even more). This will add a significant amount of space to the Brno market in the next three years, which is unlikely to be in demand for the time being. The Brno market’s absorption is facing limits and very uncertain rental conditions. Some projects planned for the future are therefore postponed.

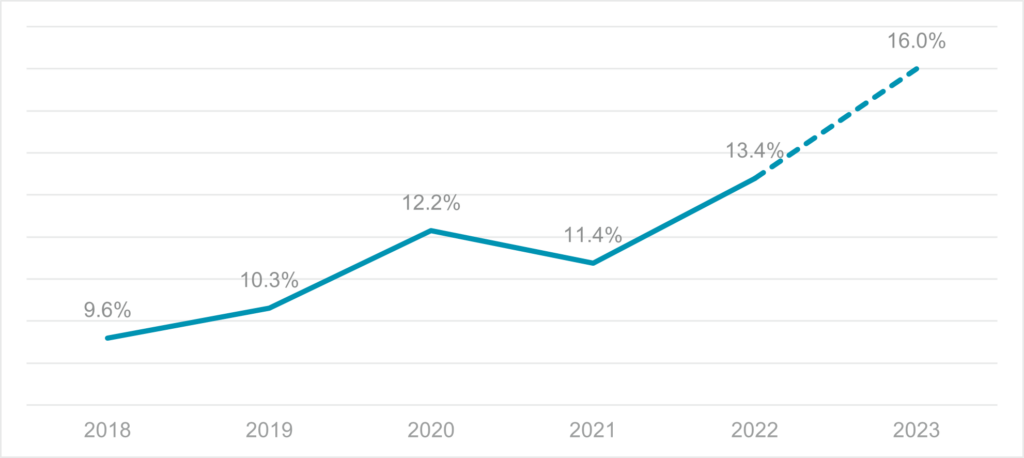

In Brno, an increase in vacancy rates of up to 16 per cent can be expected for the next few years, as there will not be enough of those interested in the new space. At the same time, construction is being carried out to a high quality, with projects meeting the ever-increasing demands of companies on the working environment and compliance with ESG principles. This, coupled with high construction costs, is increasing the pressure on rents – initially there was talk of a growth from the current EUR 16.5 to EUR 20 per square metre per month for 2025–2026.

Lukáš Netolický, Head of Regional Cities in the Czech Republic, Cushman & Wakefield: “Due to declining absorption and rising vacancy, 20 euros now seem unrealistic. There are individual projects where office space is being rented at this price, but it is not the prime rent. That will probably remain below 18 euros, also in the next few years.”

Only successful smaller technology companies with up to 100 employees and 1,000 square metres of space rented can afford to pay higher rents. However, large shared service centres, which are the main office tenants in Brno, will not accept such a price – especially in the current situation.

Investments in new offices face profitability issues

Due to the persistently relatively low rent levels and simultaneously rising construction costs, office developers in Brno have to expect much lower profitability of their projects. The average rate here is 15–20 per cent compared to 20–25 per cent in Prague. There are cases when the price of construction costs and expected profit for planned projects reaches the valuation value level of the project and even exceeds it. This makes the market less attractive, especially for institutional developers.

Speculative construction in Brno already required a considerable amount of courage – and this will be even more true for construction in the coming years. Only a well-positioned project with a good construction and leasing set-up has a chance to succeed; banks require a pre-lease of 30 to 50 per cent. On the other hand – examples from other regional cities show that demand often follows supply, and those interested in new, larger spaces often require assurances that the project will actually start construction.

Vacant space will be filled gradually and slowly

Lukáš Netolický, Head of Regional Cities in the Czech Republic, Cushman & Wakefield: “In the next few years we will see new office projects in Brno which will remain partly vacant for the time being. It will take some time before the market revives again, and vacant space will be filled gradually and slowly. This could be helped by the arrival of new companies – but that requires more active involvement of the city and the state, such as we see in other CEE regions.”